As a stay-at-home parent, managing finances can be a daunting task. With the responsibilities of caring for your children, managing the household, and maintaining a social life, it’s easy to overlook the importance of financial planning. However, neglecting your financial well-being can have long-term consequences on your family’s financial stability and security. In this article, we’ll explore the essential tips and strategies for stay-at-home parents to manage their finances effectively, ensuring a harmonious and secure financial future for their family.

Understanding Your Financial Situation

Before creating a financial plan, it’s crucial to understand your current financial situation. Take some time to gather all your financial documents, including:

- Pay stubs

- Bank statements

- Credit card statements

- Loan documents

- Insurance policies

Organize these documents and categorize them into income, expenses, debts, and assets. This will give you a clear picture of your financial situation, enabling you to make informed decisions.

Creating a Budget

A budget is a vital tool for managing finances. As a stay-at-home parent, your budget should prioritize your family’s needs and goals. Allocate your income into the following categories:

- Essential Expenses:

- Housing (rent/mortgage, utilities, maintenance)

- Food and groceries

- Transportation (car payment, insurance, gas)

- Insurance (health, life, disability)

- Minimum debt payments (credit cards, loans)

- Non-Essential Expenses:

- Entertainment (dining out, movies, hobbies)

- Travel

- Personal spending (clothing, accessories, gadgets)

- Savings and Debt Repayment:

- Emergency fund

- Retirement savings

- Debt repayment (credit cards, loans)

- Discretionary Spending:

- Hobbies

- Home improvement

- Gifts

Managing Debt

As a stay-at-home parent, it’s essential to prioritize debt repayment. Focus on paying off high-interest debts, such as credit cards, as soon as possible. Consider the following strategies:

- Snowball Method: Pay off debts with the smallest balances first, while making minimum payments on other debts.

- Avalanche Method: Pay off debts with the highest interest rates first, while making minimum payments on other debts.

- Debt Consolidation: Combine multiple debts into a single loan with a lower interest rate and a single monthly payment.

Building an Emergency Fund

An emergency fund is crucial for unexpected expenses, such as car repairs or medical bills. Aim to save 3-6 months’ worth of living expenses in a readily accessible savings account.

Investing and Retirement Planning

As a stay-at-home parent, it’s essential to prioritize retirement planning. Consider the following strategies:

- Employer-matched retirement accounts (401(k), IRA)

- Individual retirement accounts (Roth IRA, traditional IRA)

- Annuities or other investment products

Tax-Advantaged Savings

Take advantage of tax-advantaged savings options, such as:

- 529 College Savings Plan: Save for your children’s education expenses while reducing your tax liability.

- Health Savings Account (HSA): Contribute pre-tax dollars to a HSA for medical expenses, reducing your taxable income.

Financial Planning Tools and Resources

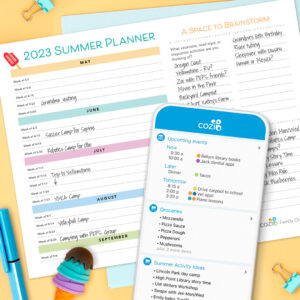

Stay organized and informed with the following financial planning tools and resources:

- Budgeting apps (Mint, You Need a Budget, Personal Capital)

- Financial planning software (Quicken, NerdWallet)

- Online financial communities and forums

- Financial advisors or planners

Conclusion

As a stay-at-home parent, managing finances requires discipline, patience, and a clear understanding of your financial situation. By creating a budget, managing debt, building an emergency fund, investing, and taking advantage of tax-advantaged savings options, you’ll be well on your way to achieving financial harmony and security for your family. Remember to stay organized, informed, and proactive in your financial planning, ensuring a brighter financial future for your loved ones.